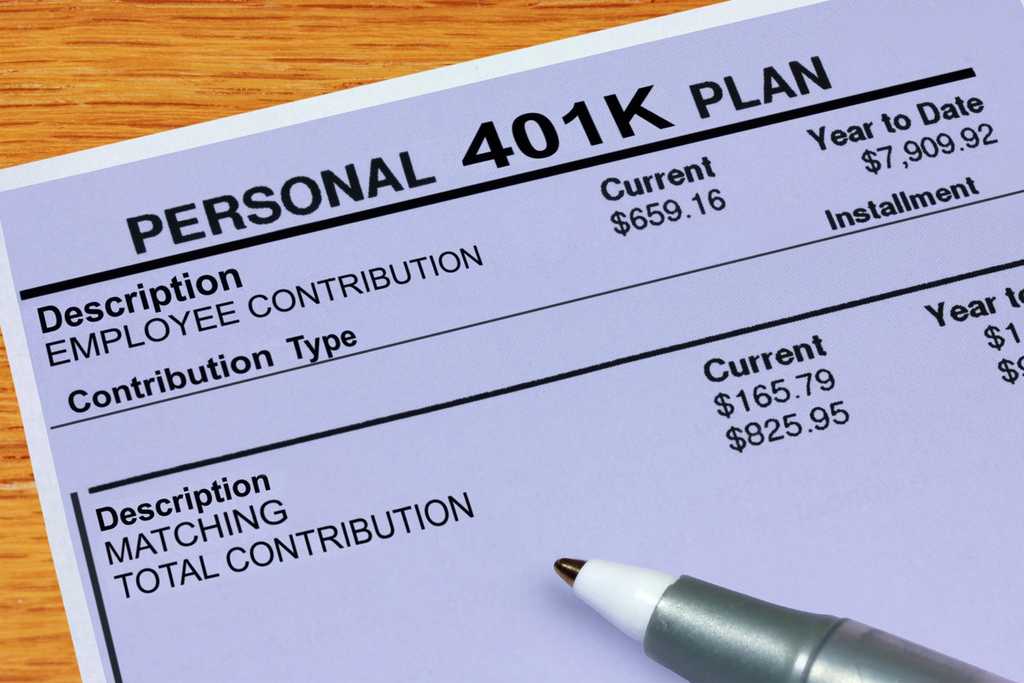

Employer matching contributions are a welcome addition to employee’s accounts. Matching contributions can enhance the amount available to plan participants for their retirement.

What is 401(k) matching?

Many employers offer matching contributions for 401(k) plan participants as an added benefit. A common matching arrangement is for the employer to match the employee’s contributions up to a specified percentage of their income.

Matching contributions are made into your 401(k) account by the employer. One thing to note, all matching contributions are made to a traditional 401(k) account, even if some or all of the employee’s contributions are made to a Roth 401(k) account. This is due to the fact the rules governing 401(k) plans mandating it be done that way.

How does 401(k) matching work?

Typically, a 401(k) match is made as a percentage of employee contributions up to a set limit. For example, an employer might match employee contributions up to the first 6% of their income that they contribute to the plan.

The match might be dollar for dollar meaning the employee would receive a full match equal to their contributions for the first 6% of their income contributed to the plan. If the match was 50% up to the first 6% of income contributed, the employee would receive a maximum of 3% if they contribute 6% of their income or more to the plan.

In some cases, employer contributions are not based on a matching employee contribution. A safe harbor 401(k) mandates an employer contribution either in the form of a matching contribution for employees who contribute, or a contribution at a fixed percentage of income for all employees whether or not they contribute to the plan. Another example of non-matching employer contributions are profit sharing contributions made by some companies.

401(k) contribution and matching limits

There are annual contribution limits for both employee contributions made from salary deferrals, as well as for employer contributions including employer matches.

For 2022, the employee contribution limits are $20,500. Participants who are age 50 or older can contribute an extra $6,500 bringing their total limit to $27,000.

Employer contributions to the plan, including both matching and non-matching contributions, have a limit of $61,000 for 2022. For those who are 50 or over the limit is $67,500. Note this is a combined overall limit for employee deferral contributions and any employer contributions. Employee deferral contributions are not limited or reduced by employer contributions.

401(k) vesting schedules

Vesting refers to the time period after which the plan participant has full rights to the money contributed by the employer. Vesting schedules for employer matches vary.

If an employer is using a graded or gradual vesting schedule that maximum length is limited to six years. The first 20% of matching contributions must be vested at the end of year two, another 20% must be vested in each subsequent year until the participant is fully vested after six years.

If the employer is using a cliff vesting schedule, this means that vesting occurs all at once after a set period of time. The maximum cliff vesting period is three years. Prior to the end of the three year period, the participant has no vesting in the employer matching contributions. Once the three year period has elapsed, the participant is immediately 100% vesting in these employer contributions.

The six year graded vesting schedule and the three year cliff vesting schedules are the maximum vesting schedules allowed. Employers can set quicker vesting schedules if they so choose.

If the employee leaves the employer before they are vested in the employer’s matching contributions, they will lose the ability to take that portion of the employer match with them. They will not be able to roll that amount over to an IRA or to a new employer’s plan.

How to maximize your employer 401(k) match

Employer matching contributions are essentially free money, they are a bonus for participating in the plan when they are offered.

Be sure to contribute the maximum amount needed to receive the full employer match. If the maximum match is 50% of the first 6% of income that you contribute, be sure that you are contributing at least 6% of your salary. For example, let’s say you earn $50,000. If you contribute 6% of your annual salary this would be $3,000. The employer match would be an additional $1,500 on top of your contributions.

Even if you contribute more than the maximum amount that will be matched, the match is still a valuable addition to your 401(k) account. The matching contributions, along with your employee contributions can all compound on a tax-deferred basis over time and potentially grow in value.

FAQs

Is a 401(k) match worth it?

The 401(k) match is almost always worthwhile for participants. Even in the case of a 401(k) that doesn’t offer great investment choices or one where the plan expenses are high, the matching contribution is still free money. Participants should generally consider contributing at least enough to receive the full amount of the match.

What is a good 401(k) match?

More is always better for plan participants. Recent data shows the average employer 401(k) matching contribution is about 3.5% of an employee’s contribution. About 51% of all employers offer some sort of 401(k) match. About 10% of all employers offer a 401(k) matching contribution of 6% or more of employee compensation.

What does a 6% 401(k) match mean?

A 6% match generally means that the employer contribution is based on the plan participant contributing 6% of their income to the plan. The employer would contribute a percentage of the employee’s contribution up to 6% of their income. This could be any percentage of their contribution up to 100%.