Did you know you may be able to save as much as $100 per month by refinancing your car loan? And as luck would have it, it’s a simpler process than most other loan refinances. How to refinance your car loan can easily be accomplished in seven simple steps. Follow them carefully, and you may get a lower interest rate and monthly payment in just one or two days.

As is the case with many financial endeavors, refinancing your car loan is a multistep process. There are seven, and you’ll need to complete each to make the refinance a complete success.

Step 1: Decide if refinancing your car loan makes sense

There are two primary reasons to refinance your car loan:

- To get the benefit of a lower interest rate and monthly payment, and/or

- To reduce the term of the loan to pay it off faster.

If the first is your primary concern, you’ll need to compare the current interest rate you’re paying on your loan with those being advertised by other lenders. It probably won’t make much difference if you’ll only be able to lower the rate by say a half-percentage point. But a reduction of two percentage points or more will make sense, especially if there are no upfront costs involved in the new loan.

You may be able to get a lower rate if either general interest rates have declined, or your credit score has improved, entitling you to a lower rate.

If your primary purpose is to reduce the loan term, it might make sense to refinance into a shorter loan term, even if there’s no reduction in the interest rate. However, an alternative is to simply make higher payments on your current loan, which will achieve the same end result.

Step 2: Check your credit – and fix what’s broken

Credit matters whenever you’re applying for a loan, and that includes refinancing your car loan. The higher your credit score, the better the terms you’ll get.

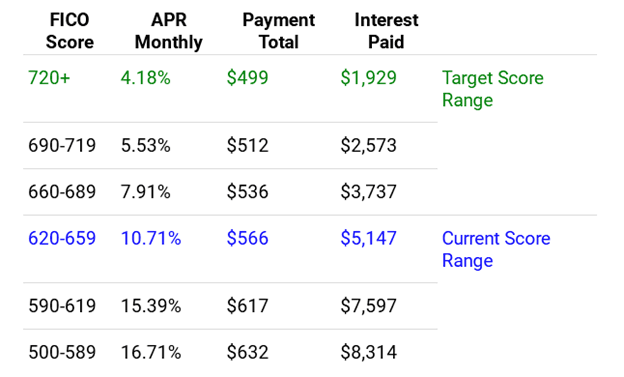

The credit website myFICO provides a table showing the impact of various credit scores on both the interest rate you’ll pay and the monthly payment. As you can see, a difference of just 30 or 40 points in your credit score can make a significant difference.

This makes a strong case for getting a copy of your credit report, complete with credit scores, before applying for a refinance of your car loan. Not only will that give you a general idea what rate you can expect to get, but it will also give you valuable time to make any improvements in your credit that can increase your credit score.

Fortunately, many banks and credit card providers make your credit score available free of charge.

Step 3: Get the value of your car

Apart from credit, how much you owe on your loan in relation to the value of your vehicle will be an important factor determining the interest rate you’ll pay. For example, you’ll pay a lower rate if the loan is 70% of the value of your vehicle, rather than 85%.

You can easily determine the value by checking free online sources. Two popular sources are Kelly Blue Book and Edmunds, since they are widely recognized even in the auto lending industry.

The lender will perform this same step, but it will help you to evaluate if refinancing is worth the effort once you know the value. And once you have it, print the report and bring it with you to the lender.

Step 4: Check Out Lenders

You owe it to yourself to get rate quotes from at least three or four lenders. Start with the current loan holder, then get two or three more. You may be surprised to see the difference in rates between lenders for a similar loan.

As an alternative, you can check out an online car loan marketplace, like Caribou. By completing a brief, online application, you’ll get quotes from multiple lenders. You can select the one that offers the best rate and terms.

Just be sure to get any rate quotes in writing, complete with terms and conditions. One lender may have a lower rate because they are charging an upfront fee. If so, you’ll have to decide if that fee is worth paying to get the lower rate.

Step 5: Assemble Necessary Documents

You’ll need to get documents together before making an application, no matter who the lender is.

Common documents you should expect to provide include:

- The vehicle identification number (VIN) of your car.

- Your driver’s license.

- Your Social Security number (required for identification and to run a credit report).

- Copies of recent pay stubs (and be ready to provide your most recent W-2 if it’s requested).

- Paperwork from your original car loan. It will include the term, interest rate, and monthly payment of your current loan.

- A payoff statement for your current loan, which you should be able to obtain from the lender, though the new lender will be able to do this as well.

By having this information readily available, you’ll minimize the amount of time it will take to get your new loan approved and funded.

Step 6: Choose your lender and apply

By now, you’ve gone through the first five steps, and you’re ready to take that crucial step of choosing a lender.

You should certainly have your current lender have the first crack at the loan, at least if you’ve been satisfied with the relationship. But if there is another lender providing a lower rate and more favorable terms, that should be your choice.

Once again, be sure to get written details of a loan offer from any lender. Then compare offers side-by-side to make sure you’re making an apples-to-apples comparison.

If you’re making an application on-site with a bank or credit union, a loan officer will likely complete the application with you. But if you select an online lender, you’ll need to complete an online application and upload any required documents.

With most auto loans, the loan decision will be made immediately by the loan officer, or within seconds in the case of an online lender.

Step 7: Review the documents and close your loan

Even if your lender has provided you with a written list of terms, rates and fees, you’ll want to carefully examine the final loan documents. Depending on the lender you use, the final documents may contain different information, or slip in unexpected provisions, like a prepayment penalty.

If any information doesn’t match with the original proposal, or you find it confusing, never be afraid to ask questions. If need be, take a timeout and have the documents reviewed by a trusted third-party.

And in a worst-case scenario, never be afraid to walk out on the deal. If the final loan documents make you feel uncomfortable, move on to another lender and find a loan that works for you.

How does refinancing a car work?

It can help to know how the car refinancing process works before getting started.

At its core, refinancing is simply a matter of replacing your current loan with a new one. That new loan should provide a tangible benefit in the form of a lower interest rate, a lower monthly payment, or a reduced loan term.

In making a lending decision and offering loan terms, the lender will evaluate your credit and income, as well as the payment history on your current car loan. They’ll also get the value of your vehicle and the payoff information on the current loan.

Your new lender will pay off your current loan directly with that lender. But you should follow up in a few days to make sure the old loan is fully paid and there is no outstanding balance remaining.

With the new loan in place, you’ll cease making payments on the original loan, and begin making them on the new loan with the new lender.

You should be pleasantly surprised to learn the car refinance process is simpler and takes less time than applying for a mortgage, a student loan, or even a credit card.

What to consider before refinancing your auto loan

When making the decision to refinance your auto loan, you’ll need to carefully consider the terms of your current loan, the available alternatives, and your ability to qualify for a new loan.

With your current loan, check and see if there is a prepayment penalty. Though these are not typical on car loans provided by banks and credit unions, they’re not unknown when it comes to subprime loans. If refinancing will trigger a prepayment penalty, it may be worth what you’ll save on a lower rate.

New loans available should provide an interest rate that’s lower than the one you’re paying now. They’ll be even more likely if your original loan was subprime, with a very high rate.

Finally, by checking your credit score and the value of your vehicle, you’ll have a good idea of your ability to qualify for a better loan. If your car has maintained its value, and your credit score has improved since you took the original loan, refinancing may be an excellent move.

When should you refinance your car loan?

You should consider refinancing your car loan if any of the following take place:

- Prevailing interest rates have fallen significantly compared to when you took the original loan.

- The amount you owe has fallen significantly below the value of the vehicle. For example, the original loan was 100% of the value of your vehicle but has since been paid down to 70% based on the current value of the car.

- Your original loan was subprime, but your credit score has improved considerably, and you can now qualify for a car loan with a bank or credit union.

FAQ

Does refinancing a car hurt your credit?

Typically, no. That’s because you’re simply replacing one loan with another, which should be a wash as far your credit score is concerned.

However, your credit score may take a slight hit if you apply with a company and they perform a hard credit check. That will show up on your credit report as an inquiry and may drop your credit score by three or four points.

Not to worry though, the impact of an inquiry is minimal and fades quickly. In fact, inquiries typically disappear from your credit report completely after just two years.

How long does it take to refinance a car?

It all depends on the lender you’re working with. Some can approve and fund your refinance in a single day, while others may take up to two weeks.

How many times can you refinance a car?

There’s no legal limit on how often you can refinance a car loan. It’s mostly a matter of whether or not the refinance makes sense for you and if the lender is willing.

The only truly limiting factor is the vehicle itself. Once the vehicle reaches a certain age and declines in value to no more than a few thousand dollars, you may not find a lender willing to make a loan.

Can I refinance my car with the same lender?

Yes, in fact, that’s probably the best lender for you to start with. Your current lender already has your loan and knows your payment history. They may be anxious to move you into a refinance to prevent you from going with another lender and losing your business.

In addition, your current lender may provide certain perks, like a slight reduction in the interest rate you’ll pay. Check with your current lender before shopping for others.