What Is A Money Order and How Does It Work?

In this world of Bitcoin, PayPal, Venmo, and the many other digital forms of payment, the simple money order may seem somewhat outdated. Where once the main options were cash, and personal checks, we now have the ability to pay with apps, credit or debit cards. So, the big question is why is there a need to still use a money order?

What is a money order?

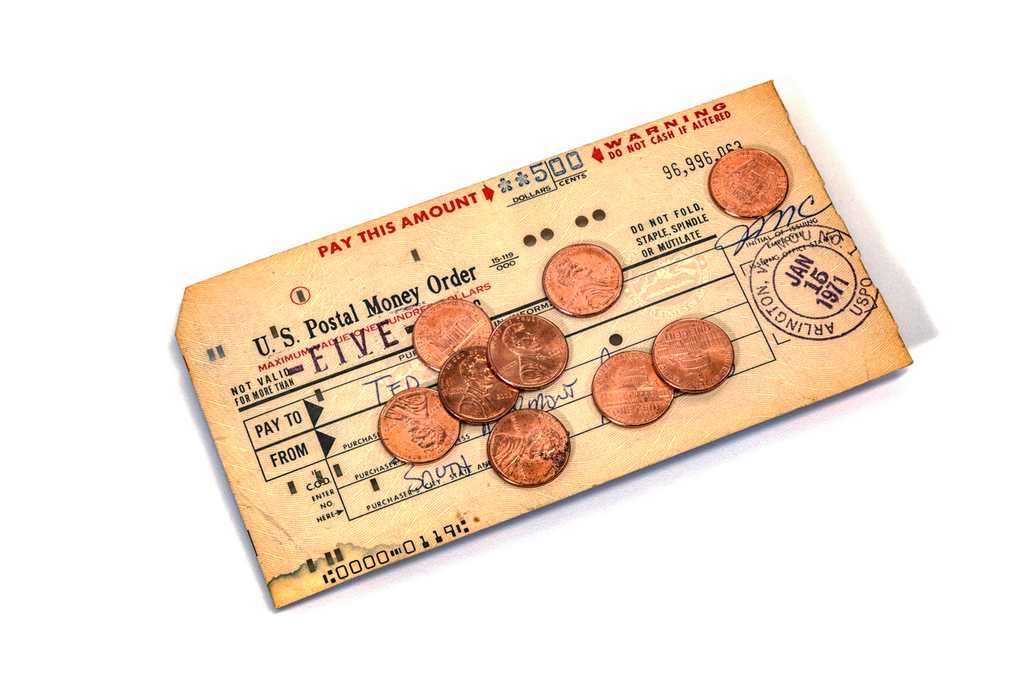

A money order is a small piece of paper similar to a check that allows the person named to receive a specified amount of cash. Unlike regular checks, money orders are prepaid. That means they're backed by large agencies or corporations instead of individuals, making them especially valuable because of the safety and reliability they provide.

In order to get a money order, you must prepay for the amount, at a location like the US Post Office (USPS), Walmart or Western Union. You can also get these from a bank or credit union. Money orders from the USPS cost a maximum of $1.65 per $1,000, but banks and credit unions can charge considerably more, but typically the costs are higher than the other alternatives.

Money orders are a safe alternative to cash or personal check , and works just like a check in that you can cash or deposit it into a bank account. They are widely available at many locations, inexpensive, and offer a much more security than paying with cash. For those that don’t have a personal checking account, money orders are a good alternative.

Buying a money order

Money orders are widely available at banks, credit unions, the US Post Office, and retailers like Wal-Mart. In order to get one, you will need to pay with cash or with a debit or credit card. (keep in mind if you pay with a credit card, you will be responsible for the high cash withdrawal and interest fees charged by your card provider). Some providers allow you to buy a money order with a credit card, but others don't, including Walmart and the U.S. Postal Service. In those cases, you'll have to use a debit card or cash to buy a money order.

In most cases, there will be a $1,000 limit. So, you will need to purchase multiple money orders when you need to make payments in larger amounts. It is fairly simple to get a money order, as long as you are prepared. You will need to:

1) Have the proper amount of cash or in your debit/credit card account.

2) Have the correct name and amount of the payee and the amount you want to send.

3) In addition to the payee’s name, you’ll need to add your name (and maybe your address) and sign the money order. (Be careful to ensure that everything is accurate because you won't be able to change the information afterward.)

4) Keep the receipt. The receipt will be a copy of the money order. You will need this in case any problems arise.

5) Tracking. The receipt will also have a tracking number so that you can verify the money got to the intended recipient.

So, when should I use a money order?

There are many times when a personal check isn’t accepted for payment, or sending cash is a risky proposition. Some examples of when money orders are a smart choice for payment.

- It's a relatively simple process to find out where a money order is — as long as you keep your receipt. Top providers like the USPS, MoneyGram and Western Union allow you to track online.

- They are a secure form of payment to send through the mail. Cash in the mail can be stolen, and personal checks include your bank account number, which you may not feel comfortable sharing with the recipient. A money order can’t be stolen like cash, and it gives no private banking information to your recipient. If you no longer have the money order or you made a mistake on it, you may be able to cancel it and get a replacement or refund — as long as the money order hasn't been cashed. If you lose the receipt and there’s problems, you’ll most likely have to pay extra to track, and it can take up to 60 days for the provider to research.

- You don’t have a checking account. Since money orders require you to pay in advance, you don't need a bank account and you can still pay bills safely.

- No bouncing of personal checks. Avoid potential insufficient funds fees because money orders are prepaid.

- The recipient can cash the order at a local bank or credit union—there’s no requirement to go to the issuer to have it cashed. This eliminates fees on the recipient’s end.

- Money orders can be deposited into a bank account for no fee.

- Sending money internationally. The money order can be issued in one country and be cashed in another country. (Not all money orders work abroad, but U.S. Postal Service money orders can be sent to about 25 countries.)

Where can I cash a money order?

Your best bet is to cash a money order at the same entity that issued it, whether that’s a bank branch, post office or other location. This way the recipient tends to avoid additional fees. When you go to check-cashing locations, convenience stores and grocery stores – they tend to pile on additional fees, which can be significant. Make sure that you have proper identification when you do cash the money order.

For those that don’t require the money right away, and have a valid bank account, depositing the money will be the best bet. Banks and credit unions typically don’t charge any fees for a money order. There are some limitations, as you might not be able to get the full amount of the money order immediately (depending on their policy).

What’s the difference between a cashier’s check and a money order?

Both are very similar; in that they offer a more secure payment vs. a personal check or cash. However, they differ in terms of where you can buy them and what they are used for.

A cashier’s check is a type of official check that is issued by a bank vs. USPS/Wal-Mart/etc. With a cashier’s check, a representative of the bank will “officially” sign it because the funds are drawn from the bank's own account. This type of payment is typically used if the purchase is $1000 or more, and if you have an account at the financial institution. The costs are slightly higher on a cashier’s check (varies, depending on your bank or credit union). But it does offer a slightly more secure way of protection. Because the bank takes the money directly from your account and puts it into its own, the check is guaranteed not to bounce. That means whoever you need to pay is guaranteed to get the money. In addition, a cashier’s check may seem more credible to the recipient vs. a money order.

Another key difference is that with a cashier's check, a bank representative will sign it because the funds are drawn from the bank's own account. Whereas with a certified check, the bank certifies the customer's signature is genuine.

How to Cash a Money Order

Cashing a money order is usually convenient, as there are several places that offer this service. These include:

- Bank/Credit Union

- Money transfer outlet like Western Union and Money Gram

- Post Office

- Grocery store (not all will provide this service)

- Check cashing location

- Convenience Store

Depending on where you live and the amount of fees paid, some of the options will be better suited for you than others.

When you have the money order in hand, you should follow these simple steps.

- Check the information (amount, name on the payee) on the money order to ensure all is correct. Depending on who and where it came from, you may want to take the extra step to verify it is legitimate.

- Find a location to cash the money order. Also, make sure you understand the fees associated with that location.

- Cash it in a timely manner. This is to ensure it is not lost, damaged, or stolen.

- Have the proper ID. Any government issued ID (driver’s license, passport, etc..) will suffice.

- Endorse the money order.

- Get your cash, and secure it before you leave the location.

- Notify the sender that you have successfully cashed the money order.

In the end, money orders may not be as popular as they once were before the digital age. However, they still fill an important need as a safer and low-cost alternative to sending cash or a personal check when you need to provide a guaranteed payment.