Are you taking advantage of one of the best cash back apps of 2022? If not, you’re missing a real opportunity! Cash back apps give you a chance to earn money from shopping and other activities that you’re already doing now. You have nothing to lose and everything to gain by signing up for one or more of these apps.

Below is our list of the 10 best cash back apps of 2022, including what each is best for, any current promotions offered, and the user ratings from the app stores where they’re available for download.

| Cash Back App | Best for | Current Promotion | App Stores Ratings |

|---|---|---|---|

Cash back for gas (not points or other rewards) | Use promo code SAVE25 for a $0.25/gal signup bonus | App Store: 4.8 Google Play: 4.6 | |

Cash back at hotels | $1 Sign-up bonus | App Store: 4.7 Google Play: 4.5 | |

Rewards on beer, wine and spirits | 3,000 points worth $3 | App Store: 4.8 Google Play: 4.6 | |

High percentage cash back | $5 after spending $15 or more | App Store: 4.8 Google Play: 4.5 | |

Earn cash back from performing tasks, as well as shopping | $10 after spending at least $25 within 30 days of account opening | App Store: 4.4 Google Play: 4.3 | |

Gift cards | $1 Sign-up bonus | App Store: 4.6 Google Play: 4.0 | |

Cash back at restaurants | $30 after spending at least $30 in the first 90 days | App Store: 4.8 Google Play: 4.1 | |

Earning points on purchases by referred friends | $10 Amazon gift card with your first purchase | App Store: 4.3 Google Play: 3.5 | |

Coupon offers | None | App Store: 4.8 Google Play: 4.6 | |

No merchant or product restrictions | None | App Store: 4.7 Google Play: 4.1 |

Best cash-back apps of 2022

Upside

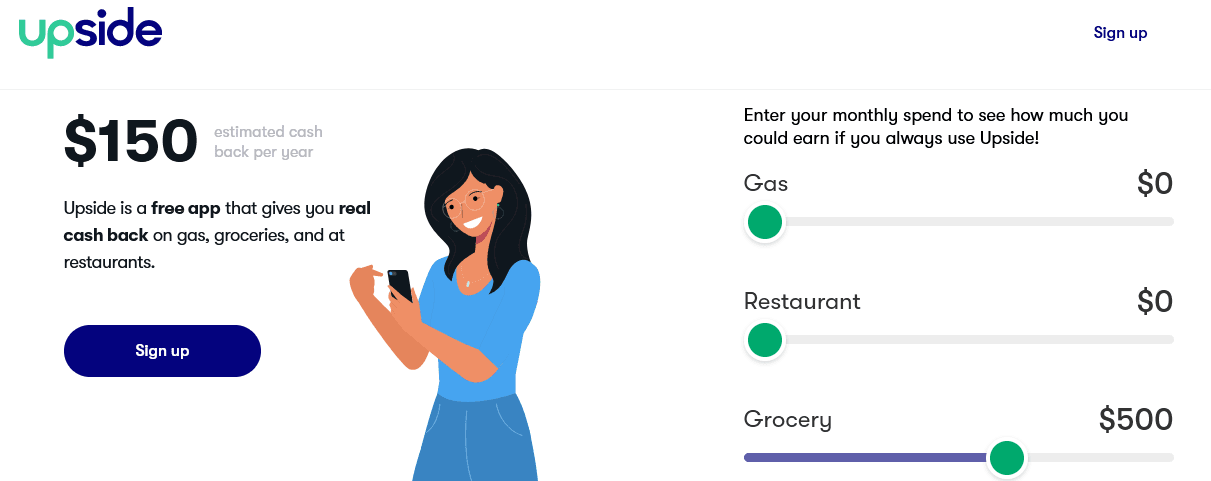

Upside is a free app providing cash back on gas, groceries and restaurants. For example, the company estimates you can earn $150 per year if you spend about $500 per month on groceries. Based on their interactive chart, you can expect to earn 2.5% cash back on groceries, and 2% on gas and restaurant meals.

The really good news is that you’ll earn cash, rather than points or rewards. You can have the cash deposited into your bank or PayPal account, or as a gift card.

Dosh

Dosh offers cash back on shopping, dining and hotels. There’s no need to collect coupons or scan receipts. You simply link the Dosh app to your credit or debit card (as well as Venmo or Jelli), use the card to make purchases, and the cash will automatically be deposited into your wallet. Once you accumulate $25, the cash will be transferred to your bank account, PayPal, or Venmo. And if you like, you can even donate your cash back to charity.

The company advertises 2% online instant cash back, 5% online instant cash back on purchases of $31 and up, and 7% online instant cash back on purchases of $51 and up. The company also reports you can earn up to 40% cash back at thousands of hotels worldwide.

Fetch

Unlike Upside and Dosh, you’ll earn points with Fetch. Those points can be redeemed for gift cards and other rewards. Points can be accumulated on a wide variety of products and services, but there seems to be an especially strong emphasis on beer, wine and spirits purchases. (1,000 points equals $1.)

Most purchases earn the base rate of 1% of the final purchase price, but it may be higher in certain situations. You can also earn bonus points for completing certain actions within the purchase. That can be scanning receipts, redeeming a reward, taking a survey, or other activities.

Ibotta

Ibotta is one of the most popular cashback apps. They advertise up to 30% cash back at thousands of top retailers, including Best Buy, eBay, Hotels.com, Priceline, Walmart, Kohl’s, Old Navy and the Home Depot.

Ibotta pays rewards in cash, which you can receive by either PayPal or gift cards, once your earnings reach at least $20.

Swagbucks

Another of the more popular cash back apps, Swagbucks enables you to earn rewards by performing tasks, as well as through online shopping. For example, you can earn gift cards and cash by using the app to complete surveys, discover new products and services and to shop with your favorite merchants.

The company claims you can earn between 1% and 75% cash back. Rewards are earned for gift cards, PayPal, cash or check.

Shopkick

Shopkick is definitely one of the more interesting cashback apps. First, they refer to rewards as “kicks.” You can get your kicks from simple tasks, like entering a partner store, scanning the barcode on select products, or making purchases. You can shop more than 80 online stores, but you can also earn kicks watching videos and browsing content on the app.

Kicks (rewards points) can be redeemed for gift cards. You can earn as many as 100 kicks for an activity and receive $1 for every 250 kicks accumulated.

Rakuten

Rakuten, formerly Ebates, may very well be the most popular cash back app there is. You can earn cash for shopping with more than 3,500 online and brick-and-mortar stores, and even earn in-store cash back when you shop in person. You can earn 5% cash back at thousands of restaurants across the country, which is calculated on your entire bill – including tips!

And you can choose to be paid by either PayPal or by a check, and the choice is yours completely. Cash back is paid on a quarterly basis.

MyPoints

With MyPoints you’ll earn points toward gift cards, travel miles (through United MileagePlus), or by cash paid through PayPal. And like a few of the other cashback apps on this list, you can earn points from taking surveys, watching videos, and even reading emails, in addition to shopping online. You can even earn points for your Groupon and LivingSocial purchases.

In addition to earning a $10 Amazon gift card on your first purchase, MyPoints has a refer-a-friend program where you can earn 10% of the friend’s qualifying points.

RetailMeNot

RetailMeNot is a coupon app. Rather than earning cash back or points, you’ll get coupon codes to use at popular retailers. For example, they offer coupons at Target and Subway with savings up to 50%, though most offers are in the 10% to 15% range.

Coupons are available on purchases of food, clothing, furniture, travel, shoes, sporting goods, and beauty, at hundreds of popular retailers. At the time of this review, RetailMeNot was advertising 1,062 offers through the app.

CoinOut

CoinOut might be the most convenient cash back app available because it gives you the ability to earn rewards from scanning your receipts from virtually any retailer for any product purchased. There’s no need to shop at specific places and you’re not limited by current offers. Just upload your receipt within two weeks of the original purchase, and you’ll be eligible for rewards.

You’ll earn between one cent and seven cents for each receipt, and you can be paid by PayPal, gift cards, or direct deposit.

Why should you use cash back or rewards apps?

Think about it logically – you’re going to shop anyway, right? You may as well earn a little bit of extra cash or other rewards for doing it. And it’s easy money, too. After all, you’ll be earning cash for doing what you would have been doing even if there were no rewards in the balance.

What’s more, the rewards can be substantial. As you can see, you can earn between 2% and 10% on purchases – and even more with certain apps. Even though it may seem like it isn’t much, it can really add up over time. For example, you may earn rewards of $200 or more on $10,000 in purchases over the course of a year. Some apps even add bonuses and special deals on top of the regular rewards.

There are also apps that enable you to earn rewards for activities other than shopping. That can give you an opportunity to earn extra cash in your spare time from visiting websites, taking surveys, and other activities you can complete from home.

How to spot scam cash back apps

There are hundreds of cash back apps offered, so you do need to be aware of potential scams. You are most likely to run into scams with new apps and those with few users.

One of the very best ways to avoid scams is by checking their user ratings on Google Play and The App Store. That’ll give you a pretty good idea who the good guys are and who the scam artists might be. Look for ratings of 4 or higher.

For additional protection, check the rating of the app with the Better Business Bureau. Not all apps will have a rating with the agency, especially the ones that are newer.

Finally, cash back apps are typically free to download and have no monthly service charges. If you come across one that has either, you have good reason to suspect a scam.

Tips for using cash back apps

There are several ways to maximize the rewards you can earn from a cashback app.

First, make sure the merchants, products and services they offer are the ones you consume regularly. An app that’s filled with irrelevant or obscure providers and products may not be of much use to you.

Second, look to combine benefits. For example, you can multiply your rewards by using a cash back app with a cash back credit card. Another example is to use multiple cash back apps to double or even triple your rewards.

Third, look for apps that provide rewards beyond shopping. An app that enables you to earn rewards from performing activities, like taking surveys, will give you an opportunity to earn even more cash. One that offers rewards on purchases by friends you refer to the service are still another way to earn additional rewards.

Fourth, and perhaps most important, don’t forget to use your cashback app when making any purchases. It’s worth a few seconds of extra time to check for special deals, discounts, and rewards before making any purchases.

FAQ

What is a cash back app?

A cash back app is a service that provides you with some form of compensation for shopping and other activities. The apps are partnered with retailers large and small, and offer rewards in exchange for promoting those retailers on the app.

They give you an opportunity to earn cash back, discounts, gift cards, rewards and promotions by taking advantage of deals offered by the app.

How do cashback app companies make money?

The companies behind the cash back app earn something like commissions when they refer customers to a merchant. The app will refund some of that commission to their users in the form of rewards. But any portion of the commission that is not paid to users will be a revenue stream for the app company.

Are cashback apps safe?

Any time you use any service that’s offered online or on your mobile device, there is at least a small risk, even if the company providing the service is completely legitimate.

That said, cash back apps are generally safe. They do collect personal information, but don’t normally request or record debit or credit card information.

Like most apps, cash back apps typically have a security disclosure, spelling out how they protect your information. Read that carefully and decide if the precautions they have in place are satisfactory to you.

Which cash back or receipt app pays the most?

There’s really no one answer to that question because it’s largely determined by your own personal habits and preferences. It will do you little good to download the app providing the highest amount of rewards if the products and services those rewards are earned on are not ones you regularly purchase.

Based on our list above, Swagbucks reports paying as much as 75%, while RetailMeNot has coupon discounts up to 50%. But you should know that these are exceptional rewards. Most will pay considerably less, with the higher-paying offers limited to a small number of merchants on a very narrow range of products and services.