No matter what anyone tells you, it takes time and effort to build credit, especially if you have none right now. But with the right strategies, you’ll not only reduce the time it takes, but you’ll build a credit score you can be proud of.

How to start building credit with no credit history

The process of building credit starts with building your credit score. When you apply for a loan, or even for an apartment rental or a job, the lender, landlord or employer will be looking primarily at your credit score.

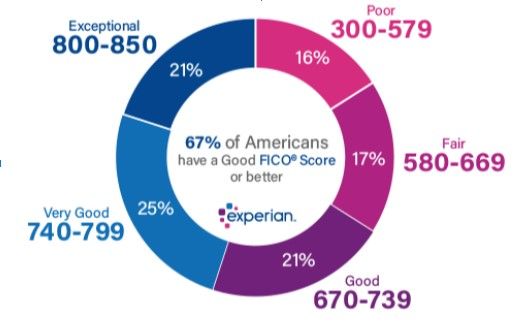

That being the case, let’s start the discussion by taking a quick look at credit scores, and determining exactly what constitutes poor, fair, and good or better credit.

Experian, the largest of the three major credit bureaus, breaks down credit scores into five major categories explained in the graphic below.

A “good” credit score begins at 670. For that reason, 670 is a worthy target if you’re looking to build credit with no credit history. After all, in setting any goal, it helps to have a target to measure your progress by.

Building credit requires a series of strategies, and you’ll need to take it one step at a time. Generally speaking, you’ll need at least two active credit lines (though three is preferred by the credit bureaus) for at least six months before a credit score will begin to register.

If you have no credit history, the goal should be to obtain those first two or three credit lines. That’s what we’ll focus on in the remainder of this article.

How to build credit with a credit card

There’s more than a bit of a paradox when it comes to how to build credit with a credit card. That’s because it’s close to impossible to get an unsecured credit card without a credit history.

Fortunately, there is a workaround. It’s what’s known as a secured credit card.

Just as the name implies, a secured credit card is a credit card collateralized by a savings account. In fact, recognizing the need for consumers to build credit, many major banks offer secured credit cards. Examples include Capital One, Discover, and Citi.

In addition to helping you build credit from scratch, a secured credit card can also help you to improve a bad credit history. Since the credit line is secured, banks are willing to issue the cards with no credit history or even bad credit history.

A typical secured credit card arrangement will provide you with a major credit card, like a MasterCard or Visa. The credit limit will match your security deposit. For example, with a $200 security deposit, you’ll have a credit line of $200.

That may not seem like much of a credit line, but it’s all you’ll need to get your credit history going in the right direction. You can use it for small purchases, like gasoline. Make your monthly payments on time, and those payments will be reported to the three major credit bureaus. As they are reported and the months pass, you’ll begin to build a good credit reference from the secured credit card.

Some banks will issue larger credit lines with a bigger security deposit. But that will depend on the amount of cash you have available for the deposit.

How to build credit without a credit card

You absolutely don’t need a credit card to build credit. In the next three sections we’re going to provide examples of ways to build credit without a credit card.

But one of the often-overlooked ways to build credit without a credit card is through student loans. Because you are a student, federal student loan programs do not require you to qualify for financing.

But this is also something of a mixed bag. If you are just starting school, or currently a student, your student loans are probably in deferral. If they are, they’re not contributing toward your credit and credit score.

One workaround to this dilemma is to set up minimal monthly payments while you are in school. For example, some programs will allow you to make monthly payments toward interest of as little as $25 per month. That payment, low that it is, will be reported to the credit bureaus. It will represent a viable credit reference that will be reflected on your credit reports, helping you to build a score.

Now let’s look at some other strategies to build credit without a credit card.

Get a credit-builder or a secured loan

Just as banks offer secured credit cards to help consumers build credit or overcome bad credit, many offer secured loans as credit-builder programs. These loans are so common that they’re offered by most banks and credit unions. And unlike secured credit cards, you don’t need to put up a security deposit.

A typical credit builder loan works something like this: You apply for a loan, which can be for $1,000, $2,000, $3,000 or more. The repayment term will be set between 12 and 24 months, with a fixed interest rate and monthly payment. The interest rate will be surprisingly low, since it is a secured loan.

Unlike the typical loan where you will receive the loan proceeds to spend, the money in a credit builder loan will be deposited into a savings account with the lending institution. As long as the loan is outstanding, you will not have access to the funds.

But here’s the almost magical part of a credit-builder loan: the lender will withdraw the monthly payments on the loan from the savings account.

That means once you take a credit-builder loan, you won’t even need to concern yourself with monthly payments. They’ll happen automatically and be reported as on-time payments with the three credit bureaus.

Credit-builder loans will not be cost free. While the principal will be withdrawn from the savings account, you’ll need to cover the interest on the loan. That’s usually accomplished by adding a small amount to the savings account, out-of-pocket. On the $2,000 loan, that may be less than $100.

Set up two or three credit-builder loans, with different institutions, and you’ll have a decent credit score in no time.

Credit building apps

If you don't have the money on hand to make a deposit on a secured credit card, but you still want to build credit starting now, a credit building app might be the answer for you.

Credit building apps come in many varieties, but fundamentally they do the same thing: you apply for the credit building service, and the app deposits its money into a locked savings account in your name. You then pay installments on this loan for a fixed time period -- usually between 12 and 24 months -- and at the end of the term, you get the principle on the loan as your savings. These apps are easy to download and don't require a previous credit history.

Brigit, an app that offers cash advances as well as a credit building feature, offers a 1-year credit building loan for $15 per month without upfront administrative fees.

Build credit with a co-signer

As an alternative to secured credit cards and credit-builder loans, you can take loans for ordinary purposes using a cosigner. This can be done either with a loan or credit card.

A perfect example is a car loan. Since the car will serve as collateral for the loan, you already have the advantage of a secured loan. But adding a qualified cosigner means you’ll be able to get a much better interest rate on the loan.

Though it’s sometimes possible to get a subprime car loan without a cosigner, the interest rate can easily be above 20%. There are other terms with subprime auto loans that can leave you owing more than the vehicle is worth for many years. That’s why these loans are best avoided.

With a cosigner, you should be able to get a traditional car loan at a lower interest rate and with a reasonable monthly payment.

The key will be the strength of your cosigner. Since you have no credit history yourself, the lender will be relying entirely on your cosigner. That person should have good or excellent credit, as well as income sufficient to carry the loan payment if you’re unable to do so.

You can do something similar with a credit card. The same bank that won’t extend a credit card to you personally with no credit history, may willingly do so with a qualified cosigner.

If the cosigner has good or excellent credit, you’ll pay a relatively reasonable interest rate, with no security deposit required. Having a cosigner may also entitle you to credit card perks, like cash back rewards.

If you have a qualified cosigner, who’s willing to help you build your credit history, this is definitely a preferred strategy.

Become an authorized user

Becoming an authorized user on a credit card not only gives you the right to use the credit card, but may also help you to build your credit score.

When you sign on as an authorized user, you’re getting the benefit of an established credit card. If the primary holder has had the card for many years, and has an excellent payment history, that may spill over to your credit.

But understand that this is a less than perfect way to build credit.

First, the credit bureaus or lender may list you only as an authorized user. This is not the same as being listed as a primary holder, and will not have the impact on your credit score you may be hoping for.

Second is the possibility that the primary holder may make late payments. Just as the primary holder’s positive payment history will flow to your credit, so will a negative history. In a worst-case scenario, a default on the credit card by the primary holder can be a disaster for your credit building efforts.

Think of an authorized user arrangement as only a supplement to other credit strategies. And be sure the primary user has excellent credit and is likely to continue doing so in the future.

Credit habits to help build credit

As you begin to build credit, you must be certain to pay all bills on time from now on. Simply getting loans or credit lines doesn’t necessarily build credit, at least not the good kind. You’ll need good credit, and lots of it, to build a good credit score. That needs to be your objective.

In addition to making the payments on loans and credit cards on time, be sure to pay all bills on time. Utilities and communications services don’t report your good credit history to the credit bureaus. But if you default on a payment plan, they can put your account into collection status. That will appear on your credit report and drag down your credit score.

Be sure not to take on too much credit at once. That can include both applying for multiple credit lines at the same time and carrying large balances.

One of the biggest factors determining your credit score is what’s known as a credit utilization ratio. The credit bureaus measure the amount of outstanding credit card debt against your credit limits. They generally like the ratio to be less than 30%.

For example, if you have a credit card with a credit limit of $2,000, on which you owe $500, your credit utilization ratio will be 25% ($500 divided by $2,000). This is a good ratio that will have a positive effect on your credit score.

But if you run the balance up to $1,500, your credit utilization ratio will rise to 75%. That will have a negative impact on your credit score.

Be sure to watch your credit utilization ratio as soon as you have a credit card.

How long does it take to build credit?

While you can build a credit score in just a few months with a couple of established credit lines, it can take years to build good or excellent credit. Those who have the best credit scores usually have a credit history that’s many years deep. It also includes a large number of credit references, most of them paid-in-full. And it should go without saying, those credit lines – both paid and open – have stellar payment records.

But you don’t need an excellent credit score to function smoothly in the world. A good credit score, say in the 680 to 700 range, will enable you to get the financing you need and at reasonable rates and terms.

By using several of the strategies listed above, you should be able to reach that range within two or three years. Keep the momentum going, and it’ll just be a few years more before you’ll see credit scores approaching 800.

In today’s credit driven world, it’s well worth the effort!