Did you know that you have more than one credit score? In fact, you have several. Credit card lenders use scores that specialize in that industry, while auto lenders have a different set of scores specific to car loans. Not surprisingly, a variation also extends to mortgages. Which credit score do mortgage lenders use?

Warning: It’s probably not the same one you’re getting from your free credit score provider!

Scores and Models Used When Applying for a Mortgage

According to myFICO, the website of the company that created FICO scores, there are at least 28 different versions available for different lending industries.

The three most popular used in connection with mortgage lending are as follows:

- FICO Score 2 (used by Experian)

- FICO Score 4 (used by TransUnion)

- FICO Score 5 (used by Equifax)

Notice that each of the three major credit bureaus issues its own FICO mortgage version. While the algorithms are similar for each, you can easily end up with three different scores on a credit report pulled on the same day. This is due to the fact that not all creditors report all three bureaus, as well as timing differences with payments.

Mortgage lenders typically pull what’s known as a Residential Mortgage Credit Report, or RMCR, which will include all three scores. The score that will be used for lending purposes will be the middle of the three scores.

For example, if your credit score with Experian is 722, 712 with TransUnion, and 728 with Equifax, the Experian score of 722 will be used, since it’s the middle of the three.

If only two scores are provided on the RMCR, the lower of the two will be used.

The reason for credit scores specific to mortgage lending is that each score puts heavier emphasis on the factors that affect mortgage lending. For example, they give greater score weight to an individual’s performance on mortgages. That includes home-equity loans and home equity lines of credit (HELOCs).

While each score will factor in performance on other loan types, like auto loans, student loans, and credit cards, greater weight will be assigned to mortgage ratings.

How Your Credit Score Affects Your Interest Rates

Mortgage lenders use what’s known as tiered pricing, in which your rate is determined by a series of adjustments based on the characteristics of your loan and your borrower profile. Multiple factors are involved, including loan amount, loan-to-value ratio, loan type (fixed rate or adjustable rate), length of the loan term, and many others.

But the biggest single factor in determining the interest rate you’ll pay is generally your credit score.

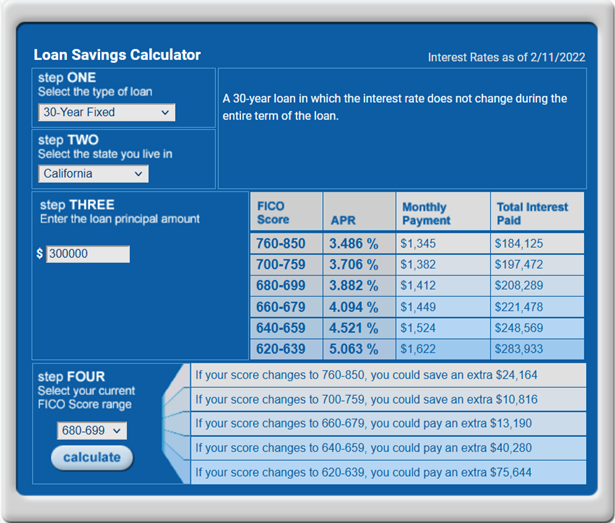

The myFICO Loan Savings Calculator shows the difference your credit score can make with both the interest rate (APR) and the monthly payment you make on your mortgage:

Notice the difference between the APR, monthly payment, and total interest paid between the 620 to 639 score range, and a 760 to 850 score range.

In the 620 to 639 range, your APR will be a full 1.577% higher than if you are in the 760+ range. Meanwhile, your monthly payment on a $300,000 mortgage will be higher by $277, or $3,324 per year.

But the really big difference will be in the total interest paid over the life of the loan. As you can see from the screenshot, you’ll pay nearly $100,000 more in interest over the life of a $300,000, 30-year loan with a credit score below 640, than you will with a score above 760.

How to Monitor Your Credit Reports

Only a mortgage lender has access to your RMCR. But you can monitor your credit report and scores using a variety of sources. Most typically, each service will provide a single score, whether it’s from Experian, Equifax or TransUnion. That may not get you access to the three scores you need. But by regularly monitoring one or two scores, you’ll have an excellent idea what your mortgage score will be, even if it isn’t exact.

There are plenty of free sources providing access to your credit score and even your credit report on a regular basis. Banks and credit unions routinely provide access to this information if you have a deposit or loan account with the institution.

In addition, there are free credit score providers, like Credit Karma and Credit Sesame. Credit Karma will provide your scores from Experian and TransUnion, while Credit Sesame provides only the TransUnion score.

But be aware that both these sources, and most free credit score sources for that matter, don’t provide your actual FICO score. Instead, they provide the educational Vantage 3.0 Score. And though it parallels your FICO Score, it isn’t an exact match.

If you’re looking for more precision in monitoring your credit score and credit report, you can sign up for a premium service. For example, you can sign up with myFICO’s FICO Advanced program, which will not only give you access to your credit report and credit scores from all three major credit bureaus, but also all 28 variations of your scores. The current cost of this service is $29.95 per month.

Meanwhile, Experian CreditWorks Premium will provide your credit score from all three bureaus each month, as well as 24/7 credit monitoring. The current price is $24.99 per month.

How to Improve Your Credit Score

If your credit score isn’t where it needs to be, there’s plenty you can do to bring it up.

Examples include:

- Dispute any negative information that is an error: Credit bureaus and credit reporting companies usually provide the capability to do this directly from their websites.

- Pay off any small loans you have: The fewer accounts with open balances, the higher your credit score will be.

- Pay down larger accounts, especially credit cards: Lowering a credit card balance by just a few hundred dollars can make a noticeable difference in your score.

- Avoid taking new credit: Not only will this avoid inquiries appearing on your credit report (and dragging down your score), but also new credit. New credit has a disproportionately high negative impact on your score since it’s unproven.

- Pay all your bills on time: This includes utilities, cell phones, and Internet and cable. Though these vendors don’t report your good payment history, they will report negative payments to the credit bureaus.

Depending on how much you want to improve your credit score, you may need to use several of the strategies above. However, give yourself enough time to implement the strategies and to have them impact your credit score.

Your patience and effort will pay off with a less expensive mortgage.